Annuities are not just for retirement income

Annuities are versatile tools in a financial plan. While they may be best known for providing guaranteed retirement income, annuities can also help you grow wealth, protect savings, and maximize Social Security benefits.

1. Earn more attractive returns.

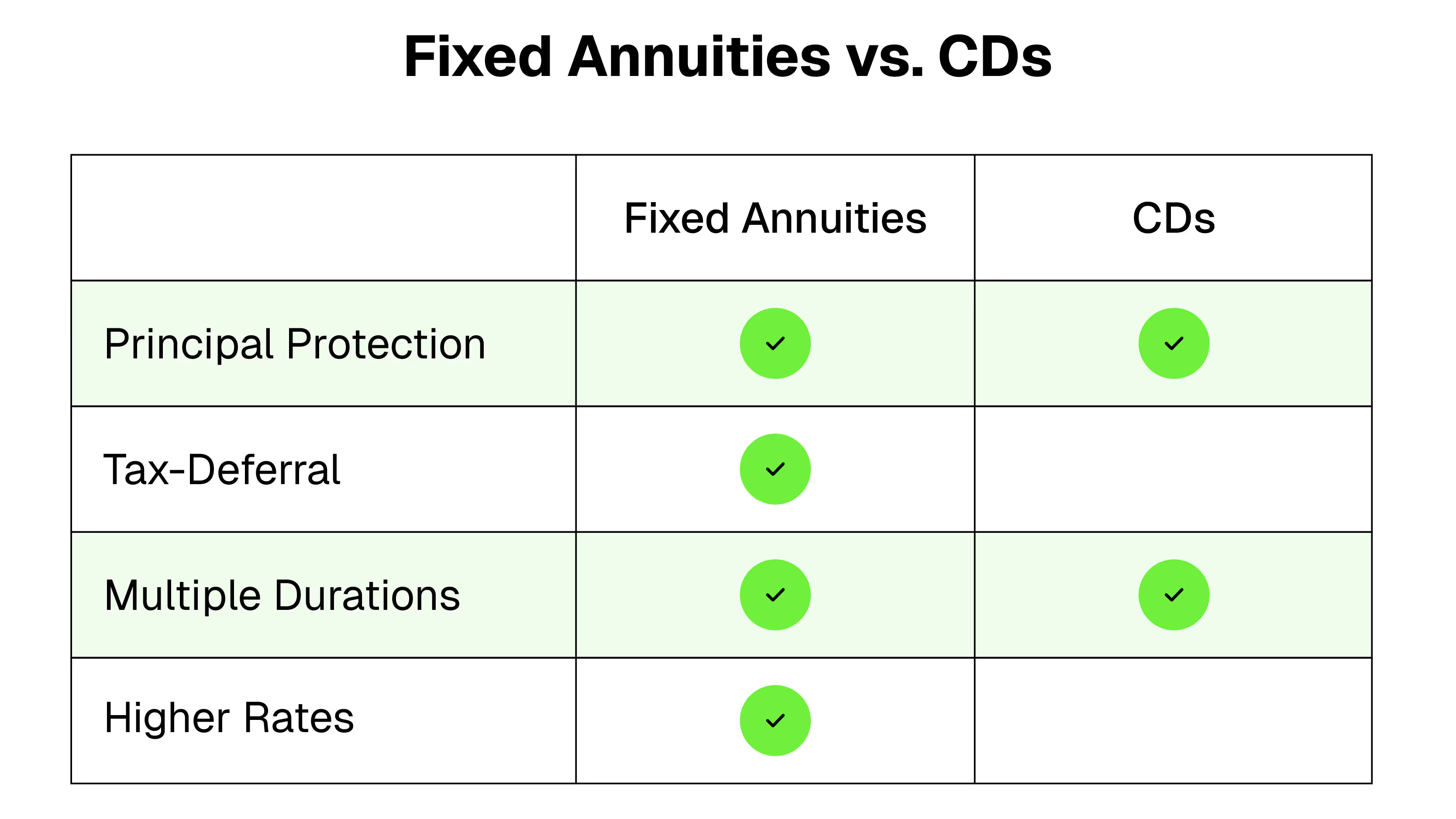

Interest rates are higher than they have been in a long time and, as a result, many types of conservative investments offer higher yields than they did just a few years ago. Commission-free multi-year guaranteed annuities (MYGAs) can be an attractive alternative to a short-term bond or a certificate of deposit (CD) because they offer similar features and, typically, a higher interest rate and more flexibility.

MYGAs are fixed annuity products issued by insurance companies. They offer a guaranteed rate of return over a specific period of time, which generally ranges from three to 10 years. MYGAs can help investors generate better returns and the interest grows tax deferred so its compounded, unlike most CDs.1

2. Protect savings in volatile markets.

Nobody wants to face a bear market in stocks like we experienced in 2022 — a drop of 20% or more — as retirement nears. Even a correction, a drop of 10%, can mean working longer or having to spend less in retirement. But many investors also suffer from FOMO — fear of missing out — and don’t want to be out of the stock market entirely.

Registered Index-Linked Annuities (RILAs), which are also sometimes called Buffer Annuities, help investors limit the extent of losses due to poor market returns while still participating in market upside.

For example, if a RILA contract has a 10% buffer over one year, the insurance company accepts the first 10% of any market loss. If the market falls by 20%, the annuity owner would see the account value drop by only 10%.

The protection on the downside creates a trade-off; return potential when the market goes up is determined by the size of the downside buffer but can still offer double digit return opportunities.

3. Grow wealth tax efficiently.

People with high incomes often look for opportunities to save in tax-advantaged accounts, like workplace retirement plans, IRAs, and health savings accounts. However, there usually are limits on how much can be set aside in tax-advantaged accounts. An option to consider if you’ve maxed out your IRA contributions, for example, is a commission-free annuity.

Annuities offer tax-deferred growth, so the assets can grow without being subject to taxes until a withdrawal is taken.

4. Create a bridge to Social Security.

The later you take Social Security benefits, the higher the amount you receive. In 2024, the top benefit for someone who retired at:2

- Age 62 was $2,710 a month

- Age 67 was $3,822 a month (full retirement age)

- Age 70 was $4,873 a month

Since many Americans will live for 30 or more years in retirement, maximizing the income received from Social Security can make a big difference. Annuities can help people who retire before full retirement age by providing income until they begin taking Social Security payments.

For example, an early retiree can roll over a portion of a retirement plan account, or another type of savings or investment account, into an annuity that will deliver income until they are ready to turn on their Social Security benefits.

Annuities can deliver powerful benefits before and during your retirement. They can help you:

- Earn more attraction returns

- Protect savings in volatile markets

- Grow wealth tax efficiently

- Create a bridge to Social Security

If you have questions about whether an annuity is right for you, we can help.

[press-a-contact-location]

1 Guarantees are based on the claims paying ability of the issuing insurance company

2 “What is the maximum Social Security retirement benefit payable?” Social Security Administration. January 2, 2024. Cited February 17, 2024.

.avif)