Products

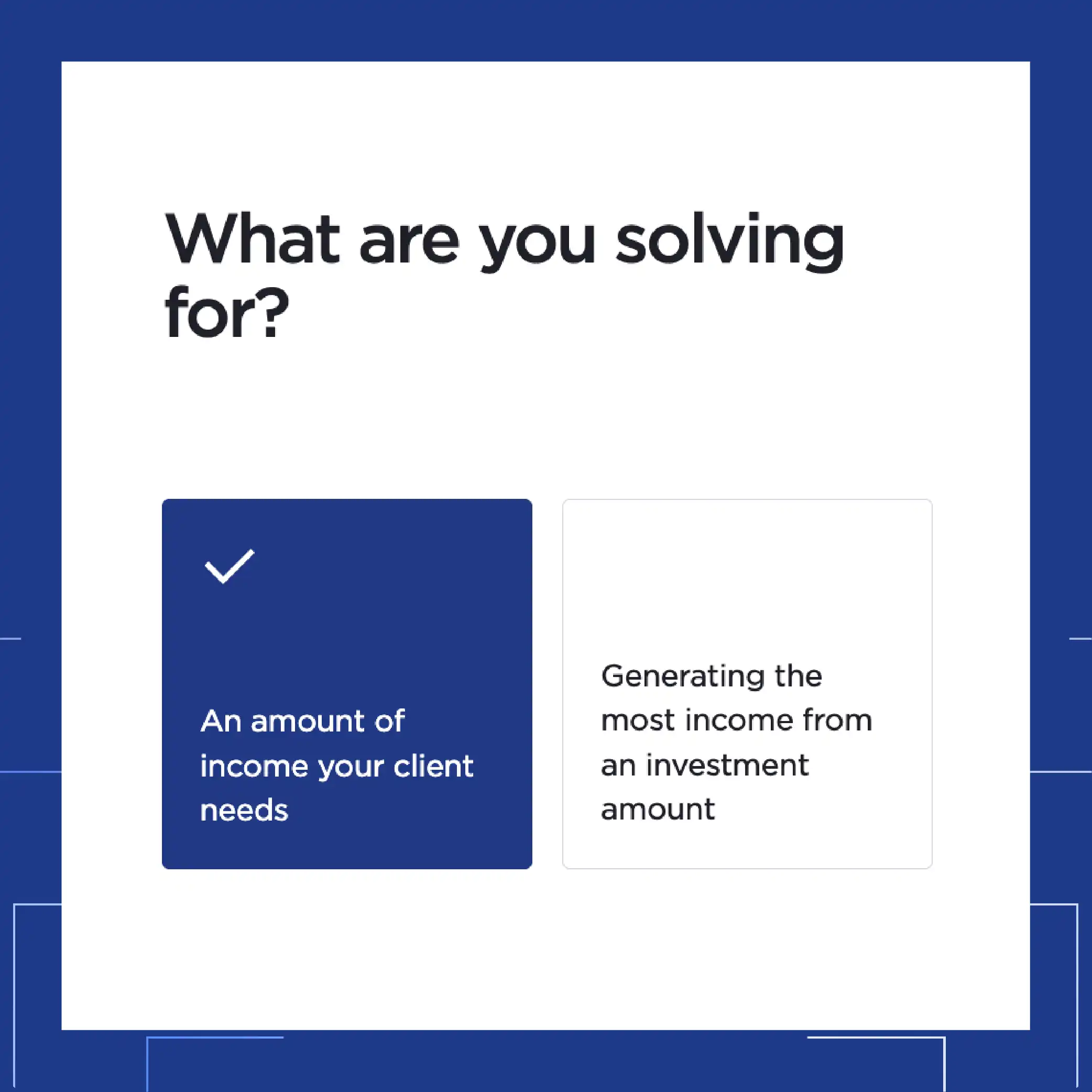

Explore Fee-Based Annuities Through Avenew.

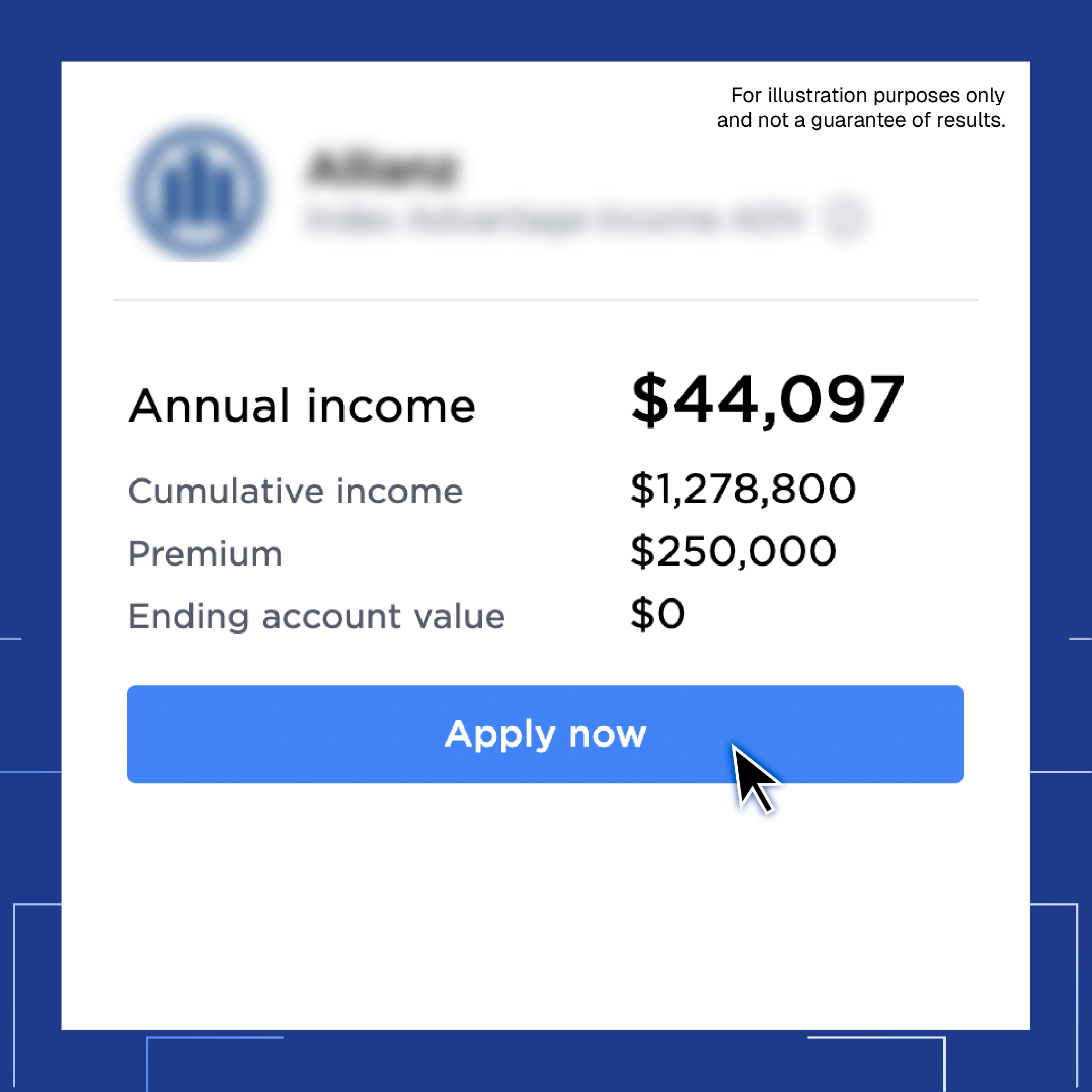

DPL's platform, Avenew, makes it easy to discover, fulfill, manage, and bill on fee-based solutions to meet client goals, giving you flexible options that fit the way you serve your clients.

Fee-Based Annuities

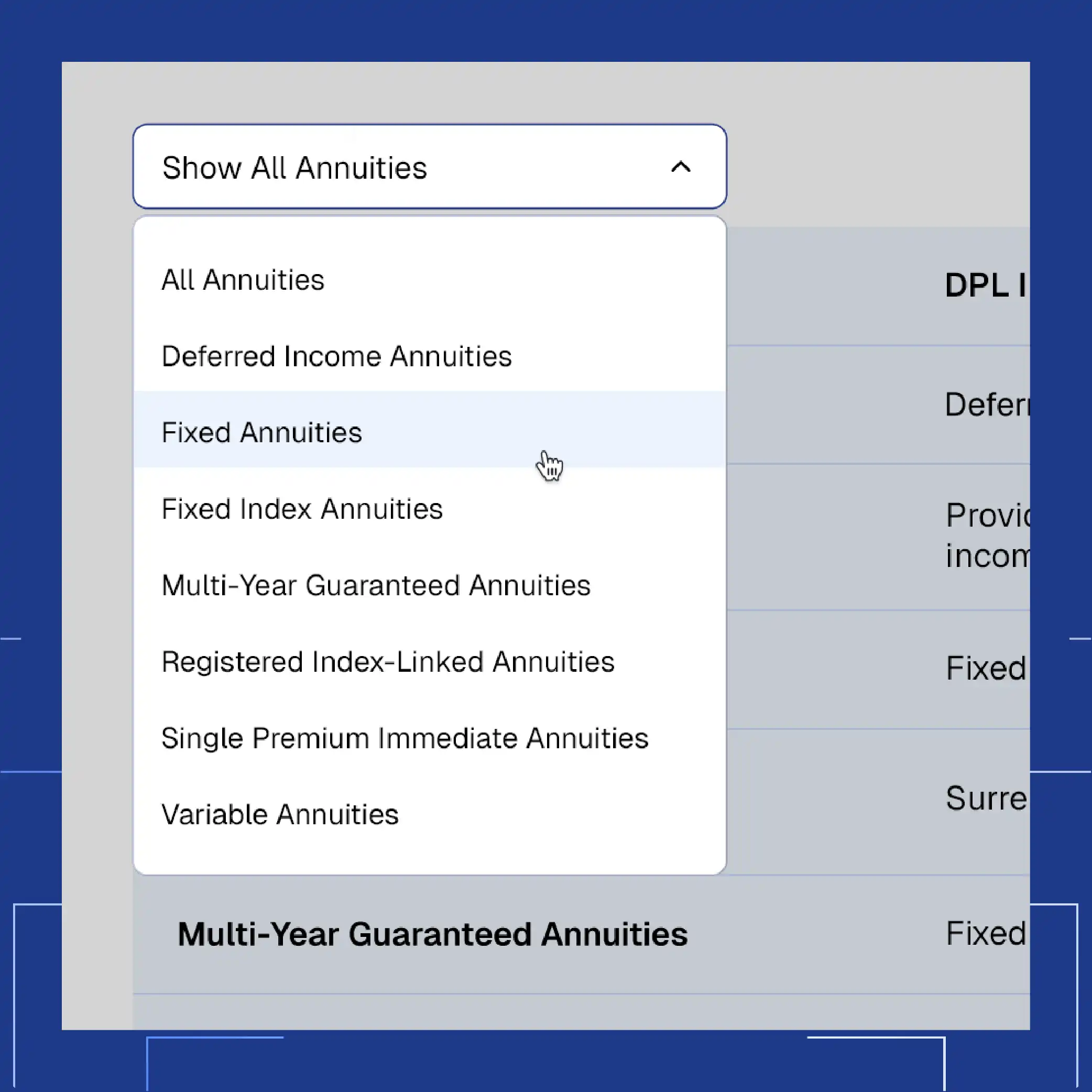

Explore 75+ commission-free annuities from leading carriers, including products designed by DPL with advisor input.

Product Type

DPL Insights

Product Type

Deferred Income Annuity

DPL Insights

Deferred income annuities are designed to bridge an income gap and maintain an income floor to cover basic expenses in retirement.

Product Type

Fixed Annuity

DPL Insights

A fixed annuity (FA) provides a guaranteed stream of income in retirement through fixed payments for a set period or life of the annuitant that will not fall below a certain level.

Product Type

Fixed Index Annuity

DPL Insights

A fixed index annuity is a tax-deferred insurance product that provides market upside while protecting principal from market losses.

Product Type

Multi-Year Guaranteed Annuity

DPL Insights

A multi-year guaranteed annuity (MYGA) is a type of fixed annuity offering a tax-deferred guaranteed rate of return over a duration from two to ten years.

Product Type

Registered Index-Linked Annuity

DPL Insights

A registered index-linked annuity is a tax-deferred product that provide upside potential with a defined degree of downside protection.

Product Type

Single Premium Immediate Annuity

DPL Insights

A single premium immediate annuity is a contract funded with a single lump-sum payment (premium) in exchange for guaranteed income payments to begin within a year of purchase.