Deliver better retirement results with RISA®

Your first step in the retirement income planning process

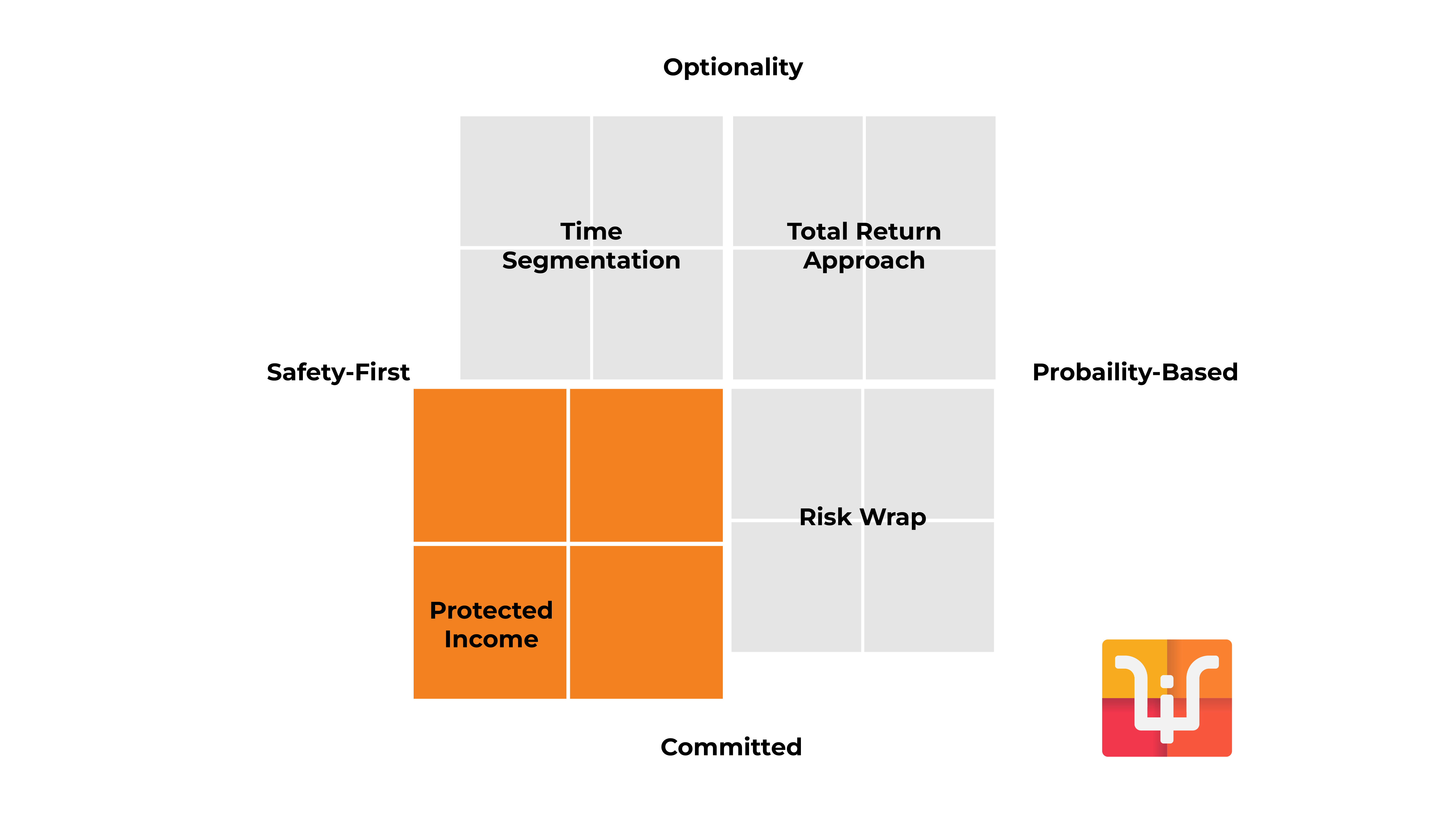

Understanding your clients’ needs and earning their trust are key to your success. That’s why retirement researchers Wade Pfau and Alex Murguia created the Retirement Income Style Awareness® (RISA) Profile — a psychology-based income personality assessment that transforms retirement planning conversations and outcomes. DPL Members can access RISA through the DPL dashboard.

How RISA works

Completed in just 15-20 minutes, your client’s responses to the questionnaire will reveal their unique preferences for sourcing retirement income. More than a simple risk assessment, the custom report generated from their answers will guide you in delivering retirement income solutions tailored to each client's wants and needs.

“Every client is different, so understanding their unique needs is key to building a plan they can stick with,” says Independent RIA and DPL member Andrew Lippert.

See how he uses RISA as a first step in the planning process.

How to use RISA

Use as a first step in the planning process, to validate current plans ― especially during periods of market volatility ― and to attract new clients by showing you care about their preferences, not just their goals.

“It's important to align clients with strategies that work for their unique personalities,” says Independent RIA and DPL member Bob Witt. “The solution that looks best on paper might not be one they’re able to stick with during tough times.”

See how he uses RISA to validate existing plans.

How to use DPL

When RISA results indicate a need for guaranteed income, asset protection or a mix of the two, DPL’s marketplace of Commission-Free solutions can help you deliver an effective plan your client can stick with.

“With DPL, we have a partner to bring the RISA Profile to more RIAs and clients looking for personalized retirement income solutions,” says retirement researcher Alex Murguia.

Learn from RISA creator Wade Pfau how he recommends using the psychology-based income personality assessment to transform retirement planning conversations and outcomes.

Behind the scenes with RISA

Hear retirement researcher and RISA creator Wade Pfau, advisor Shannon Stone and DPL’s Ross McGoodwin discuss psychological assessment as an essential first step in retirement planning, how RISA transformed Shannon’s approach to developing retirement income strategies, and why the assessment can help spouses have equal voices at the retirement table.

Determining a role for annuities within the RISA

Learn about the importance of annuities in modern retirement plans, the benefits different annuity types deliver, and how they align with clients’ RISA results. This whitepaper examines how to effectively integrate annuities into your financial planning practice in ways that align with the advisory business model.

RISA is discounted for DPL Members. Log in to get started or fill out the form to learn more about membership.