About DPL Financial Partners.

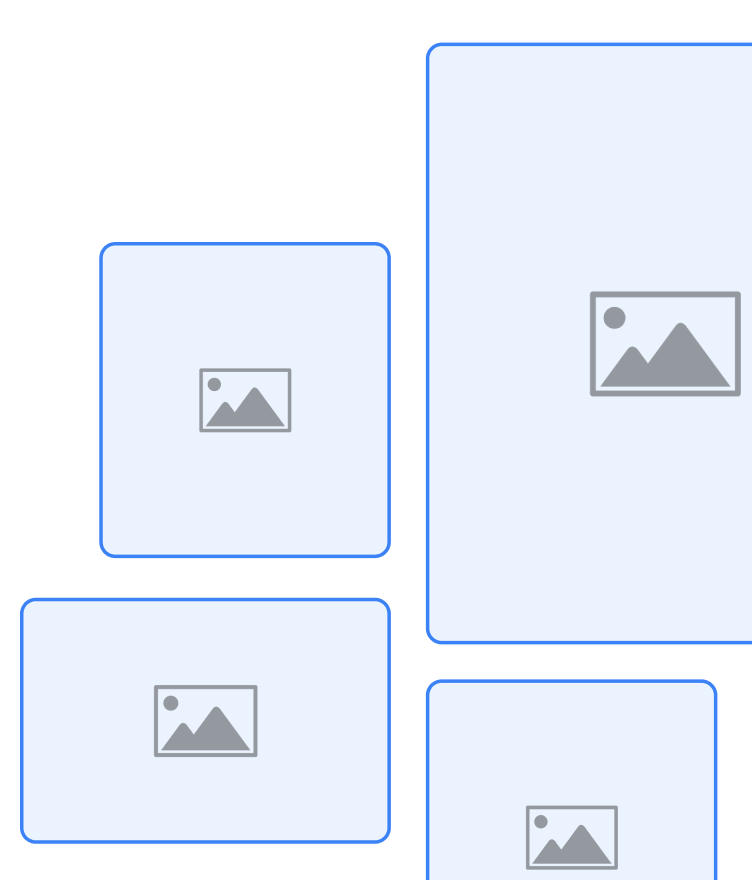

We’re on a mission to modernize annuities by bringing disruptively priced products and easy-to-use technology to market.

Delivering value is at the heart of everything we do.

DPL Financial Partners was founded to remove the problems created by commissions—complex and expensive products, conflicted sales practices, eroded benefits—and put the power in the hands of fiduciaries and retirement investors.

Our Values

Core beliefs drive every decision.

We are a trusted resource for thousands of financial advisors, top rated carriers, leading WealthTech providers, and a growing community of retirement investors seeking value-focused solutions.

DPL empowers fiduciaries and individual investors to improve financial outcomes with commission-free products and technology to make informed choices.

We use academically validated strategies and data to bring transparency and clarity to the process of evaluating and purchasing annuities.

Our goal is to upend the status quo by modernizing annuity products and processes through innovative product design, technology, and partnerships.

The insurance industry is massive and expands far beyond product manufacturers. We partner with stakeholders across the ecosystem to drive change.

We started with innovation.

We haven't stopped.

DPL is forging a path forward through intentional innovation designed to drive meaningful, lasting change.

DPL Leadership

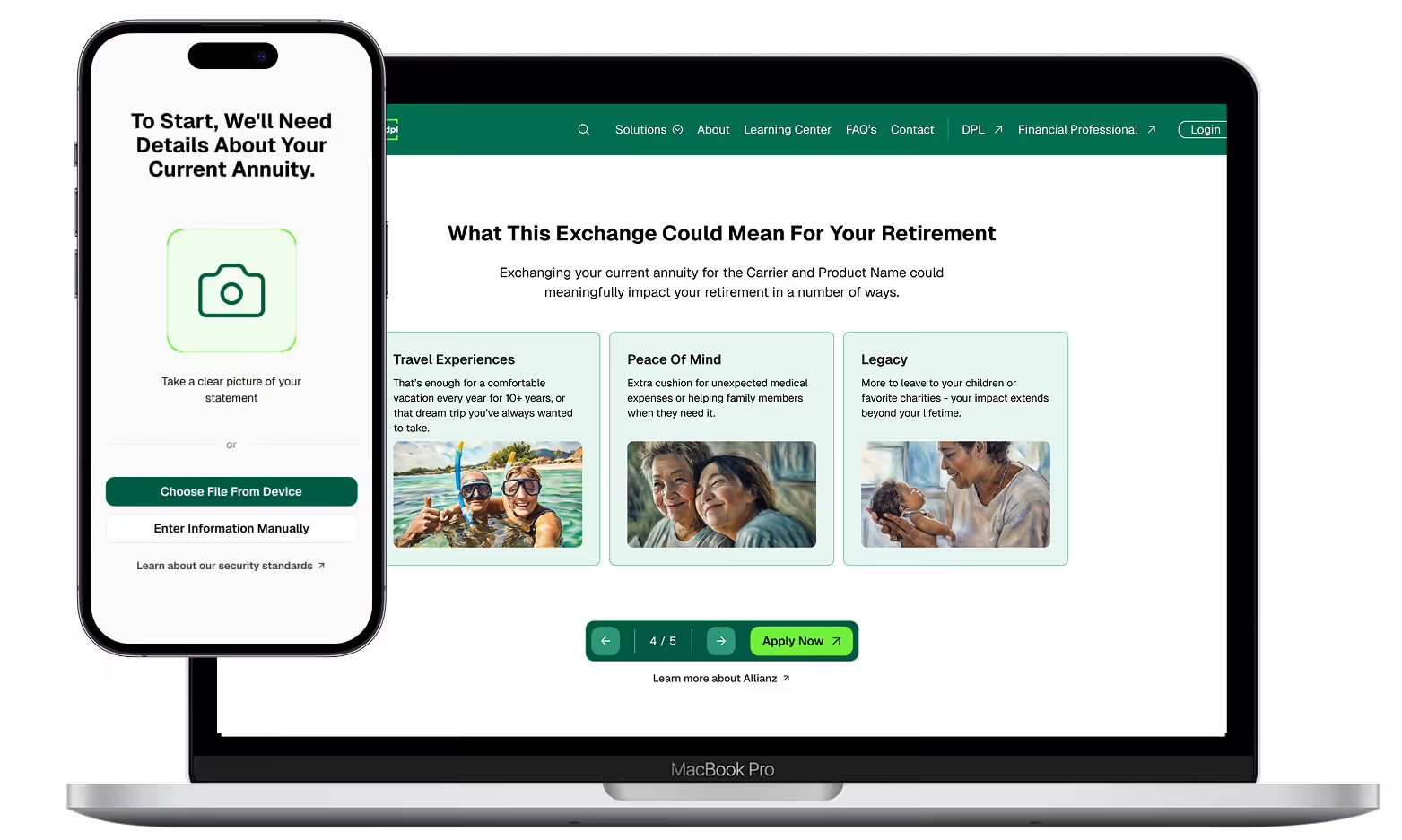

DPL Financial Partners is led by Founder & CEO David Lau and an experienced team committed to delivering better solutions for advisors, their clients, and consumers.

David Lau is widely recognized as an innovator and disruptor in the financial services industry.

He is the Founder and Chief Executive Officer of DPL Financial Partners, a privately held financial services firm that specializes in the development and distribution of low-cost, commission-free insurance and annuity products, as well as technology-driven product discovery tools and education, for Registered Investment Advisors (RIAs) and individual investors. Since going to market in 2018, DPL has worked with 20 leading insurance carriers to bring a range of value-driven, no-load products to its turnkey insurance management platform for advisors, and built an advisor base of more than 10,000 advisors from more than 3,500 RIA firms.

Mr. Lau is a sought-after speaker, commentator, and adviser to financial journalists, insurance carriers, RIA firms, fintech providers and others in the financial services and fintech industries. His work has received coverage in The Wall Street Journal, The New York Times, Barron's, CNBC, Wealth Management, and other financial media where he provides insights on industry products, players, trends, and best practices.

Mr. Lau serves on the CFP Board's Standards Resource Commission, and also on the Insurance sub-committee, to help develop resources that provide guidance to CFP® professionals and their firms on CFP Board’s new Code of Ethics and Standards of Conduct.Prior to founding DPL, Mr. Lau was Chief Operating Officer of Jefferson National, a leading innovator of tax-advantaged investing strategies for RIAs and fee-based advisors, where he led sales, marketing, technology, operations, and service. During his tenure, Mr. Lau architected the industry’s first flat-fee variable annuity product, Monument Advisor, and grew it into the leading no-load variable annuity in the market.

Prior to joining Jefferson National, Mr. Lau was principal and co-founder of The Oysterhouse Group, LLC, a management consulting firm focused on retail delivery of financial services products, where he developed “go-to-market” strategies for key initiatives. His firm’s list of internationally recognized clients included Shinsei Bank, Merrill Lynch and Ace Insurance Group.Earlier, Mr. Lau served as Chief Marketing Officer of E*Trade Bank, and its predecessor TeleBank, the first pure-play internet bank. As the chief marketing strategist, he was responsible for creating and implementing break-through national direct marketing and branding campaigns that defined the online banking category.

During Mr. Lau’s six-year tenure deposits at the bank grew from $200M to over $8B, and, at the time of its sale to E*Trade, TeleBank was the largest internet bank worldwide and five times larger than all US competitors combined.In his leisure time, David enjoys spending time with his family, playing golf and cooking. Additionally, David is a diehard Boston Red Sox fan and an avid Duke basketball fan.

Heather Rosato is an experienced marketing and communications strategist with 25 years of experience helping founders, CEOs and executive teams build their brands and grow their companies.

Prior to joining DPL, Ms. Rosato was a consultant to numerous technology startups in digital health, ecommerce, fintech and other verticals. Previously, she served as managing director of The Oysterhouse Group, where she worked with DPL Founder David Lau developing strategies for new initiatives within leading financial services companies, and as vice president of advertising at E*Trade Bank and its predecessor Telebank, the first pure play internet bank.

Earlier in her career, Ms. Rosato had roles developing marketing campaigns and building brands at Ogilvy & Mather, MTV Networks and Interface Media Group.

Tom Smith joins DPL with a passion for bringing innovative retirement solutions to market for Americans and extensive experience in the insurance, retirement planning and asset management worlds. With expertise in distribution, operations, and marketing, he is a change agent and consensus builder who forms and manages strategic partnerships that optimize relationships and leverage shared resources for growth.

Previously, Mr. Smith spent 31 years with Principal where he held a number of key roles at the global leader in financial products and services to business, individual, and institutional clients. He most recently served as Executive Director – Head Global Firm Relations where he built and leveraged strategy to maximize larger strategic partners as pivotal revenue drivers. Prior to that role, he was Vice President / National Sales Director – Retirement & Investment Services spearheading distribution for multiple product lines (institutional, defined benefit, not for profit, non-qualified, and third partner administration) in sales, marketing and growth, and consistently meeting aggressive AUM and revenue targets.

Todd Nuckols heads up the engineering and IT teams at DPL, bringing over 25 years of experience across the C-Suite and virtually every role in IT services from quality assurance to product management to CTO.

Before joining DPL, Mr. Nuckols guided technology and operations at EnterBridge Technologies and built a nationally recognized startup accelerator, Lighthouse Labs, in Richmond, Virginia. Mr. Nuckols has brought disruptive technology to field service, workforce, distribution, commerce, and business intelligence industries.

He looks forward to translating innovation principles learned in building progressive technology platforms and enhanced by working directly with startup founders across a variety of sectors into ground-breaking platforms and services for the DPL team and our customers.

Steve Werrlein heads up business development activities at DPL, bringing over 25 years of strategic development experience in technology-driven start-ups, federal IT contracting and trade associations.

Prior to joining DPL, Mr. Werrlein led business development for Stratera Technologies, a developer of software and leading-edge systems that served the business, operational and mission critical support needs of federal and commercial customers. Previously, he led marketing and business development for several technology start-ups that delivered pricing and margin optimization, wireless data and logistics/mobile asset management solutions in the commercial marketplace.

John Barkeley is the Chief Financial Officer, leading the finance and accounting teams at DPL.

Prior to joining, John held senior finance and strategic operating roles at early-stage technology companies, including EdjSports and Champion Gaming Group, Inc. Earlier in his career, John was a Vice President at DH Capital, a technology-focused merchant bank, specializing in the Internet infrastructure, communications, and SaaS sectors. Throughout his tenure there, he supported the completion of more than $2.5B in various M&A, capital raising, and principal investment transactions. John began his career in the audit practice at Deloitte and is a registered CPA (state of Michigan). John holds a B.S. in Business from Miami University.

Erik George leads DPL's data and analytics strategy.

He works to ensure that the company effectively manages, analyzes, and leverages data as a strategic asset. Erik began his career in financial services and actuarial science, including time at a national distributor. He’s happy to have come full circle at DPL and to use operational reporting and advanced analytics to drive efficiency and increase growth.

In between, he spent time developing and delivering analytics solutions at seminal analytics providers (Numerify, Snowflake) and large enterprise (GE), alike.

Tom McCarthy leads DPL’s sales and distribution channels, with the goal of accelerating the firm’s continued expansion into advisory-centric insurance, structured solutions, and enterprise-level adoption across the RIA and wealth-management ecosystem.

Prior to joining DPL, Tom served as EVP & Head of Wealth Sales at Orion Advisor Solutions, where he led a large national distribution organization that drove significant asset-flow growth, more than doubled RIA adoption of wealth services, and secured major enterprise integrations of wealth and planning solutions. Previously, Tom spent over 20 years at AssetMark, where he helped the firm scale from $1B to more than $100B in AUM, navigate a successful IPO, and generate a 5x multiple on invested capital for investors.