Who We Serve

We Help Fee-Only Advisors Better Meet Client Needs.

Fiduciary advisors now have access to modern, commission-free annuities that align with their business model and deliver client value.

How DPL's low-cost solutions benefit fee-only advisors.

Expand Offering

- Offer a wide range of low-cost, high-value annuity solutions

- Provide efficient guaranteed lifetime income options

- Get fiduciary product recommendations based on clients' goal

Grow Practice

- Expand share of wallet with annuities and insurance solutions

- Bring held-away annuities under your fiduciary umbrella

- Protect and strengthen client relationships

Expertise and Education

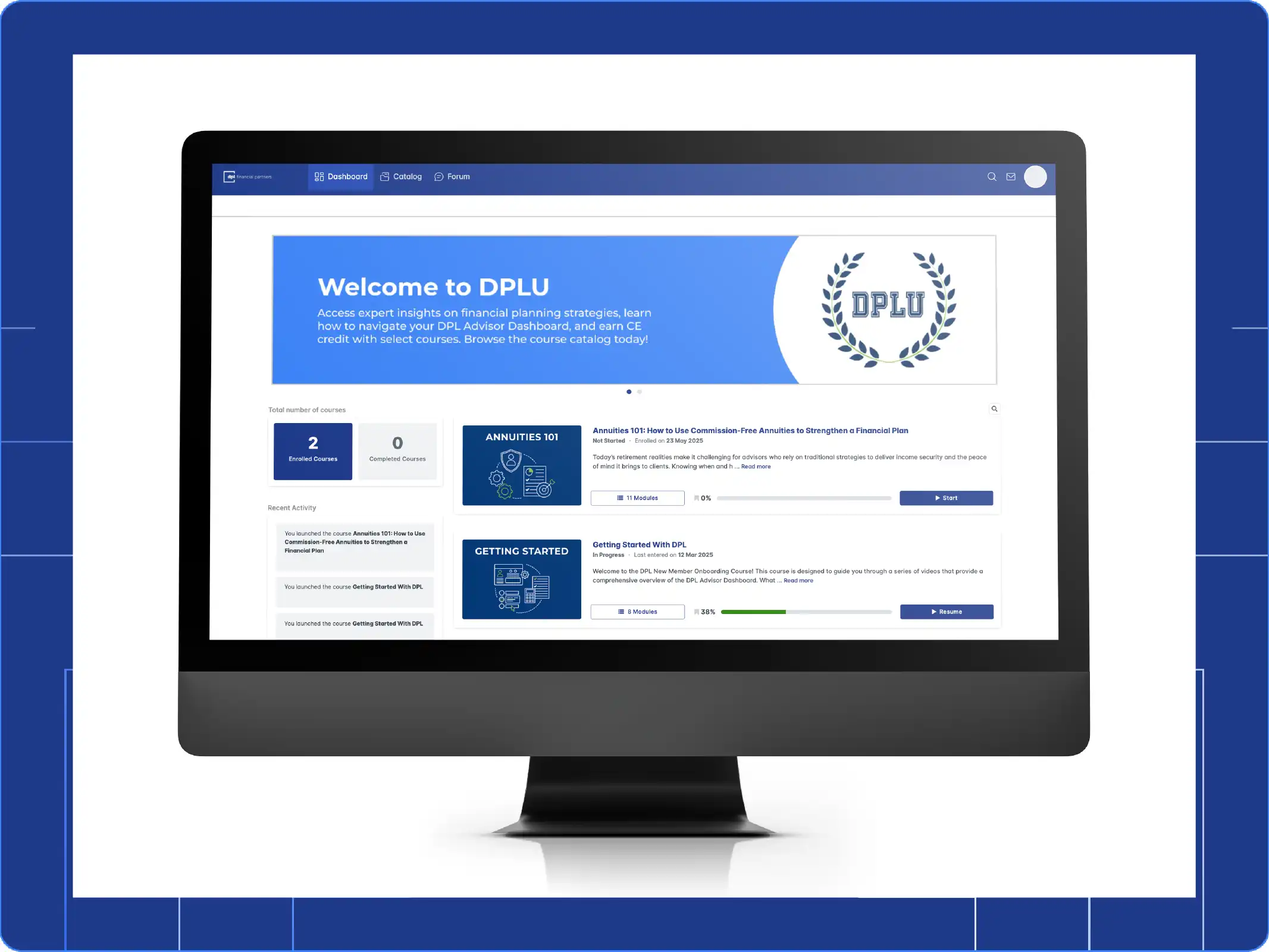

- Access on-demand educational resources and CE courses

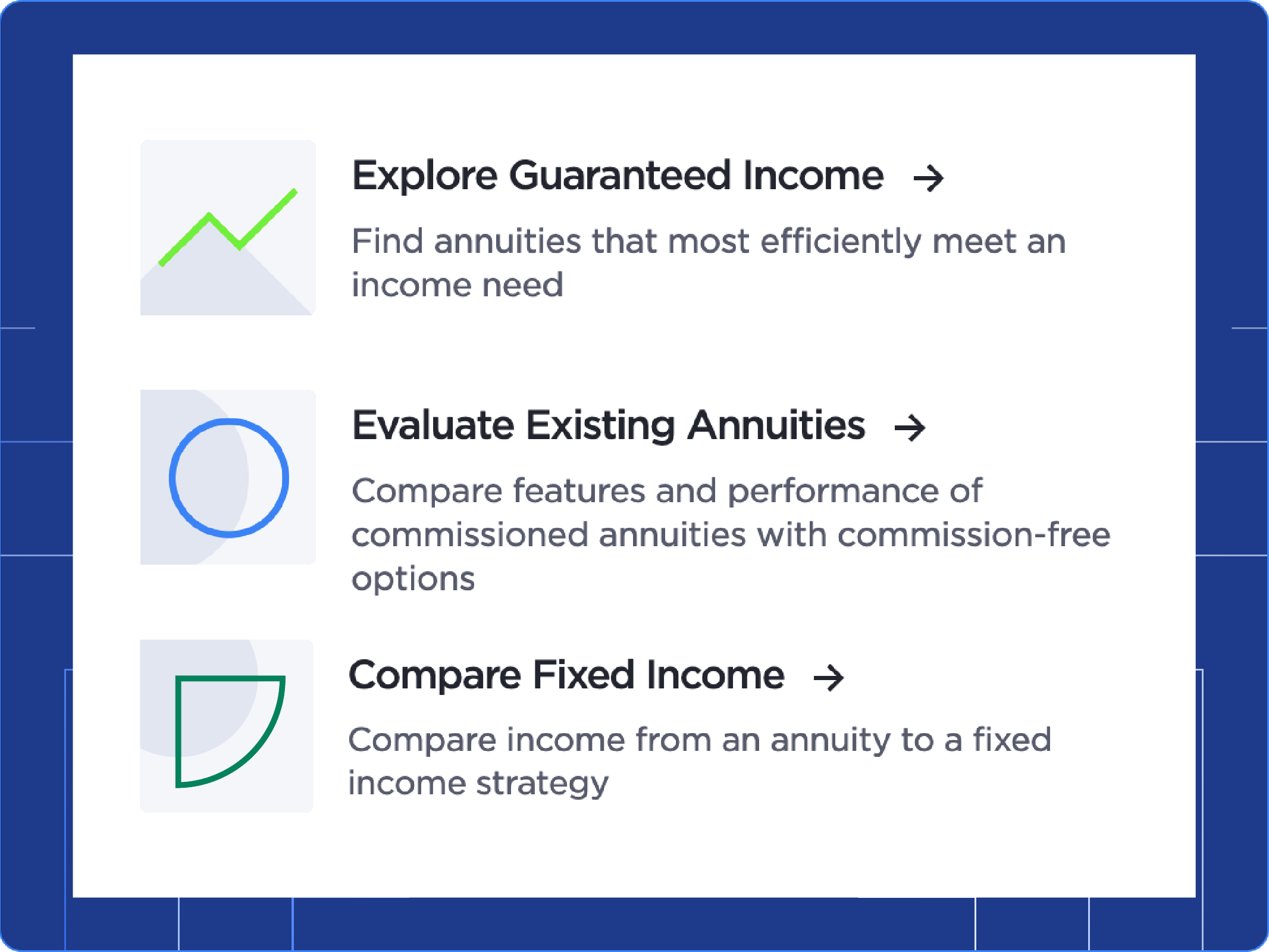

- Leverage technology to discover, fulfill, manage and bill on annuities

- DPL makes recommendations and serves as agent of record

Modern Annuities and Insurance for RIAs

Schedule time with our team to see how your practice can grow with fee-based annuity solutions and technology built for the way you work.