Fixed Annuity

A fixed annuity (FA) provides a guaranteed stream of income in retirement through fixed payments for a set period or life of the annuitant that will not fall below a certain level.

Fixed Annuity (FA)

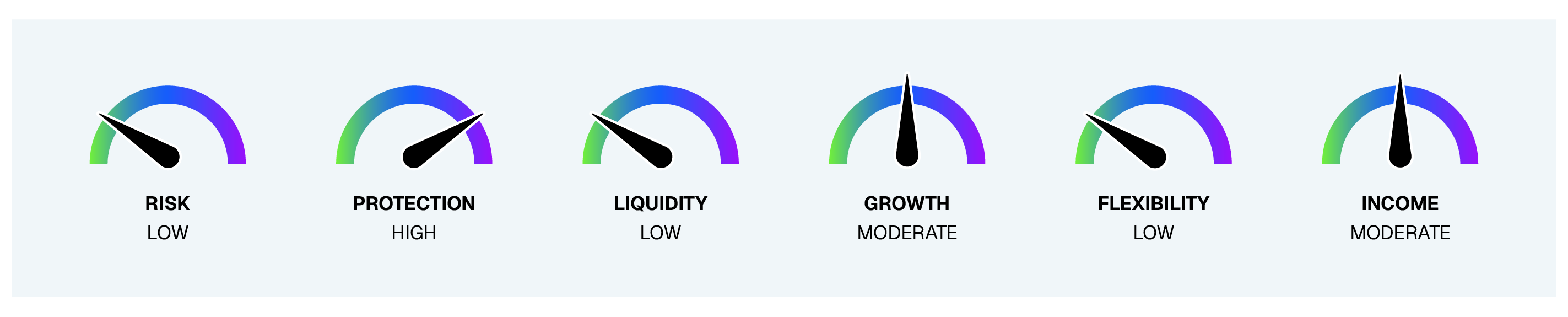

Client Risk Profile: Low

Protection Level: High

Key Benefits: Complete principal protection with a guaranteed rate of return for a specific period of time; assets grow tax deferred; multi-year guaranteed annuities, or MYGAs, are a type of fixed annuity.

Funding Source: Qualified retirement accounts like a 401(k) or IRA, cash, certificates of deposit.

A fixed annuity (FA) provides a guaranteed stream of income in retirement through fixed payments for a set period or life of the annuitant that will not fall below a certain level. The principal is not exposed to market volatility. However, the payments are not income adjusted for inflation without an added cost-of-living adjustment, or COLA, rider benefit. One potential tradeoff with the COLA rider is a lower initial payment amount to offset the future increases.

Consider an FA when you’re looking for:

Guaranteed Income: An FA is most often used to create a stream of reliable income to supplement other sources of retirement income, such as Social Security of 401(k)s.

Principal Protect: These products offer complete principal protection, providing peace of mind to the owner against the risk of outliving your assets.

Income Gap: An FA can provide a steady bridge of income for retirees as they adjust from receiving a steady paycheck to taking Social Security.

Disclosures:

Surrender charges, market value adjustments and other contract charges may apply that can reduce the principal.

Guarantees are backed by the financial strength and claims paying ability of the issuing insurance company.

There are risks, fees and charges associated with fixed annuities.

The purchase of an annuity within a retirement plan that already provides tax deferral under sections of the Internal Revenue Code results in no additional tax benefits. An annuity should be used to fund a qualified plan based upon the annuity’s features other than tax deferral. All annuity features, risks, limitations, and costs should be considered prior to recommending the purchase of an annuity within a tax-qualified retirement plan. In addition to surrender charges, withdrawals are subject to income tax.

Withdrawals prior to age 59 1/2 may also be subject to a 10% federal tax penalty.

Contact Us

Have more questions about our insurance offering? Call us at 888.327.0049 to speak to a DPL Consultant.