Back to Platform Overview

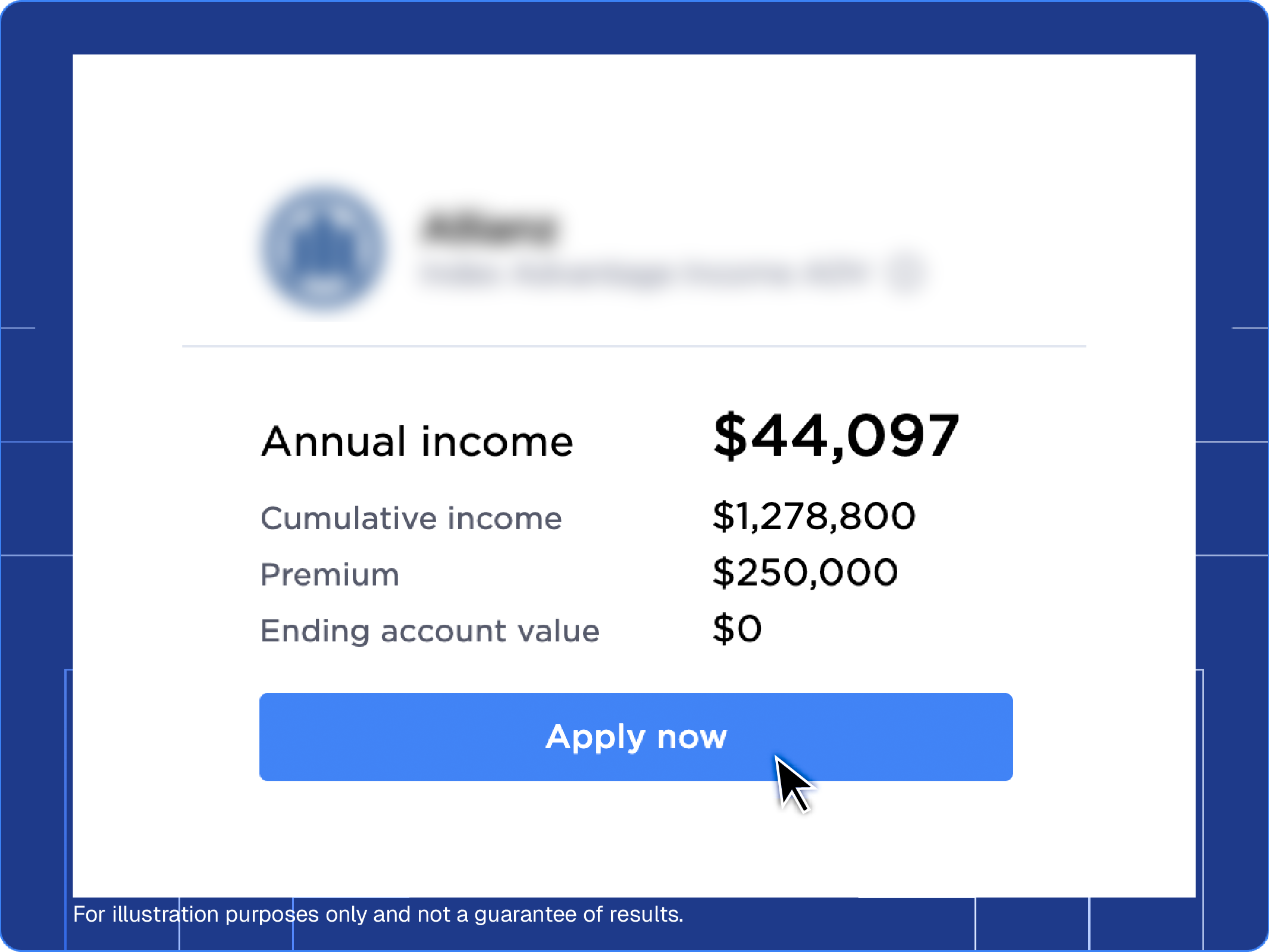

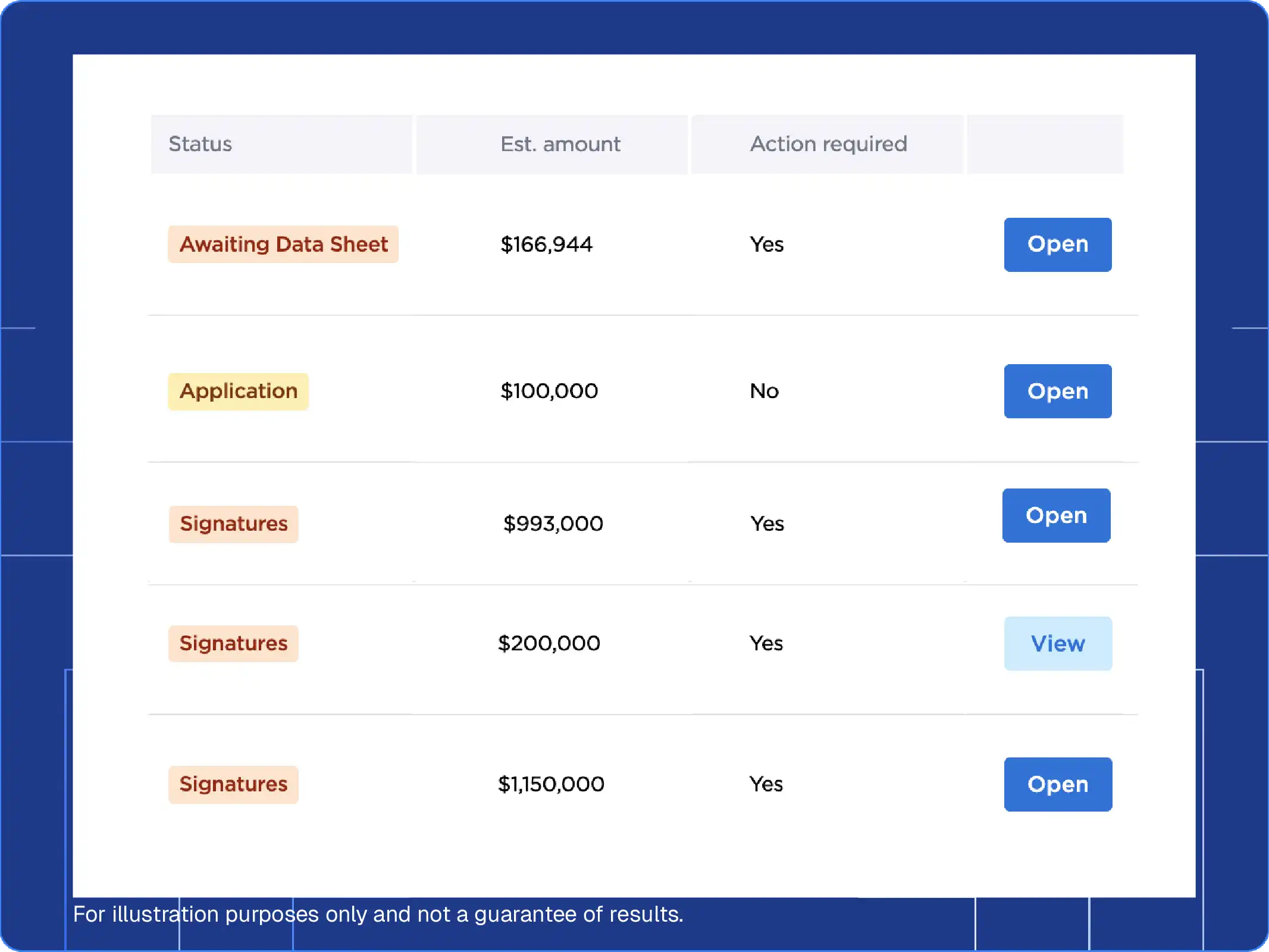

Fulfill Clients' Insurance Needs with Avenew.

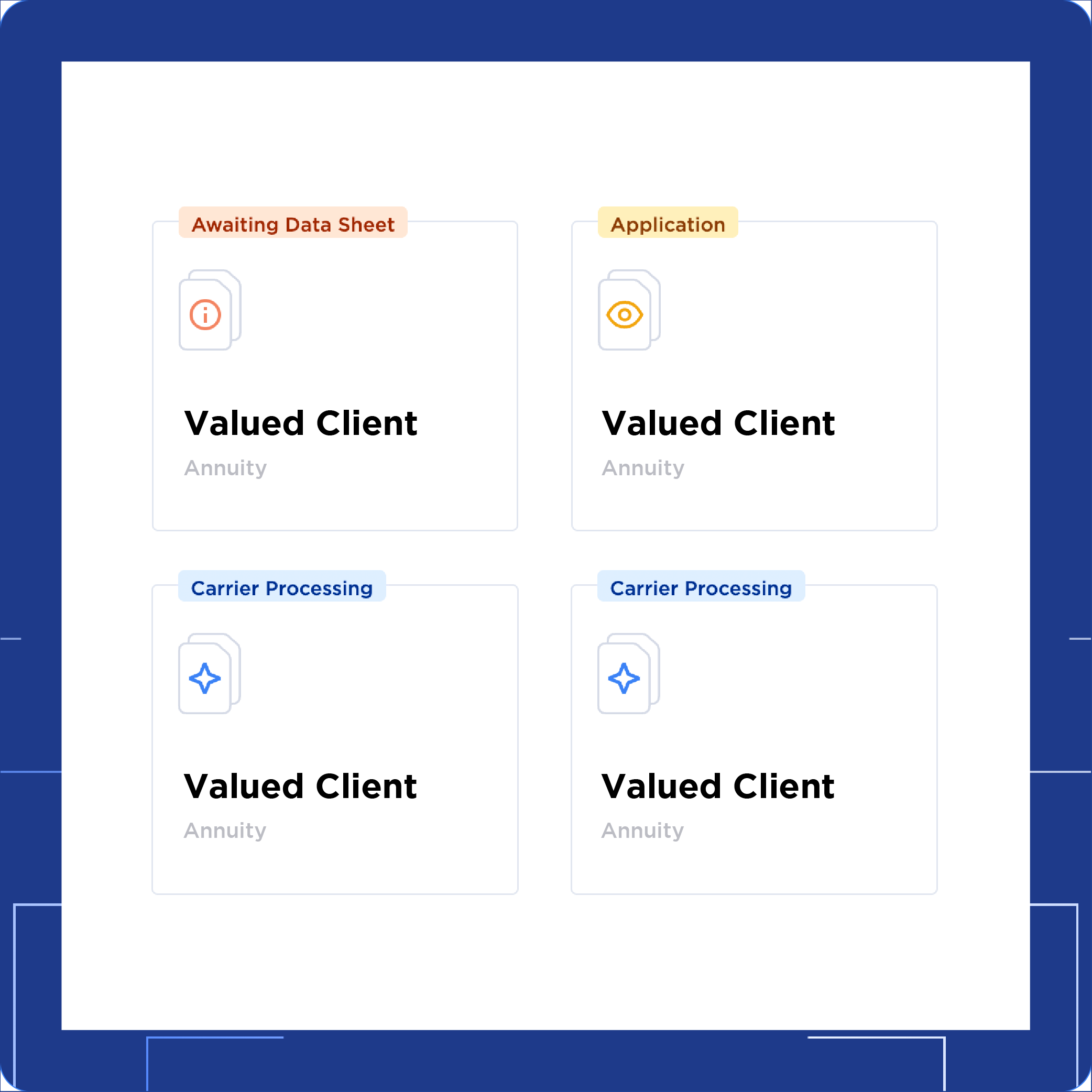

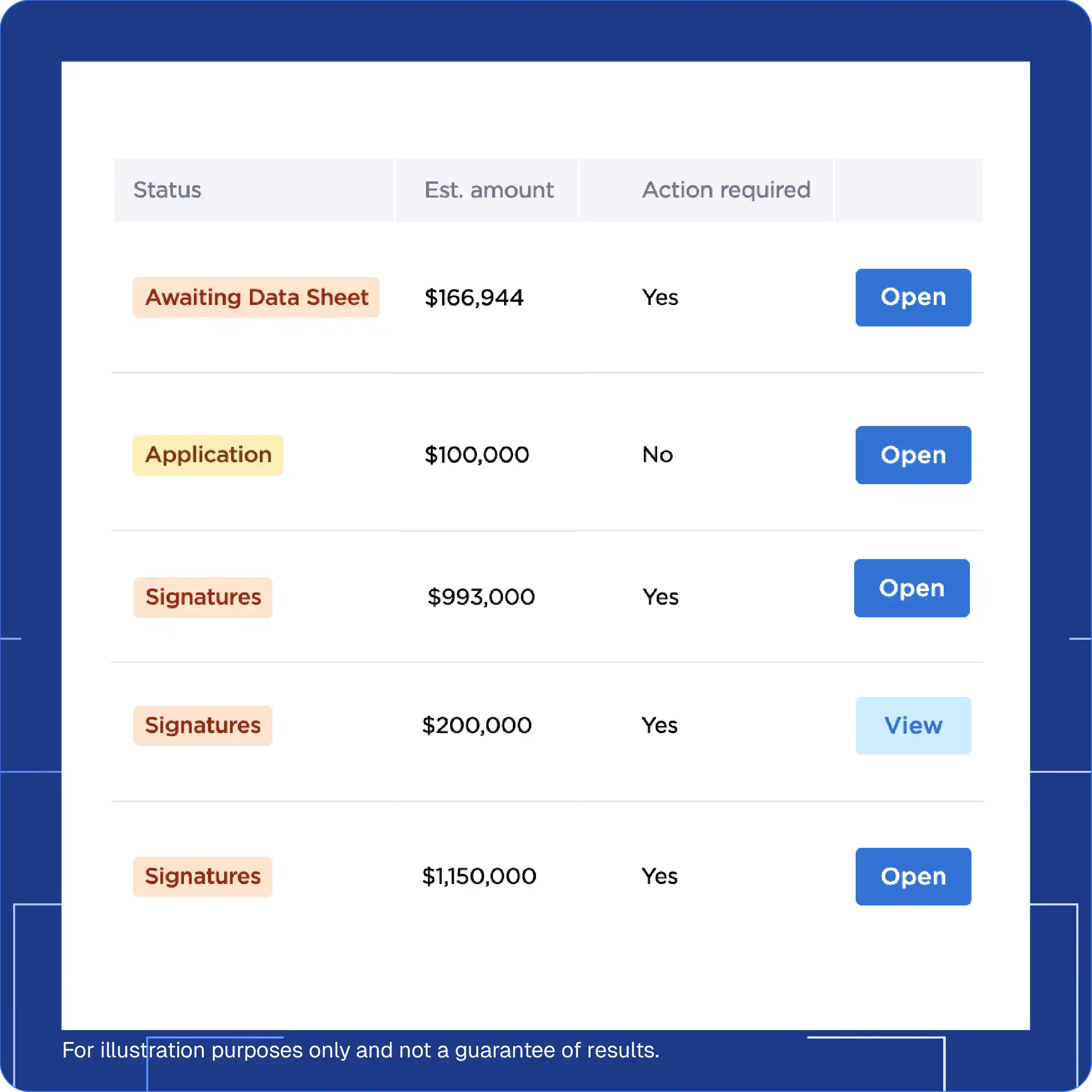

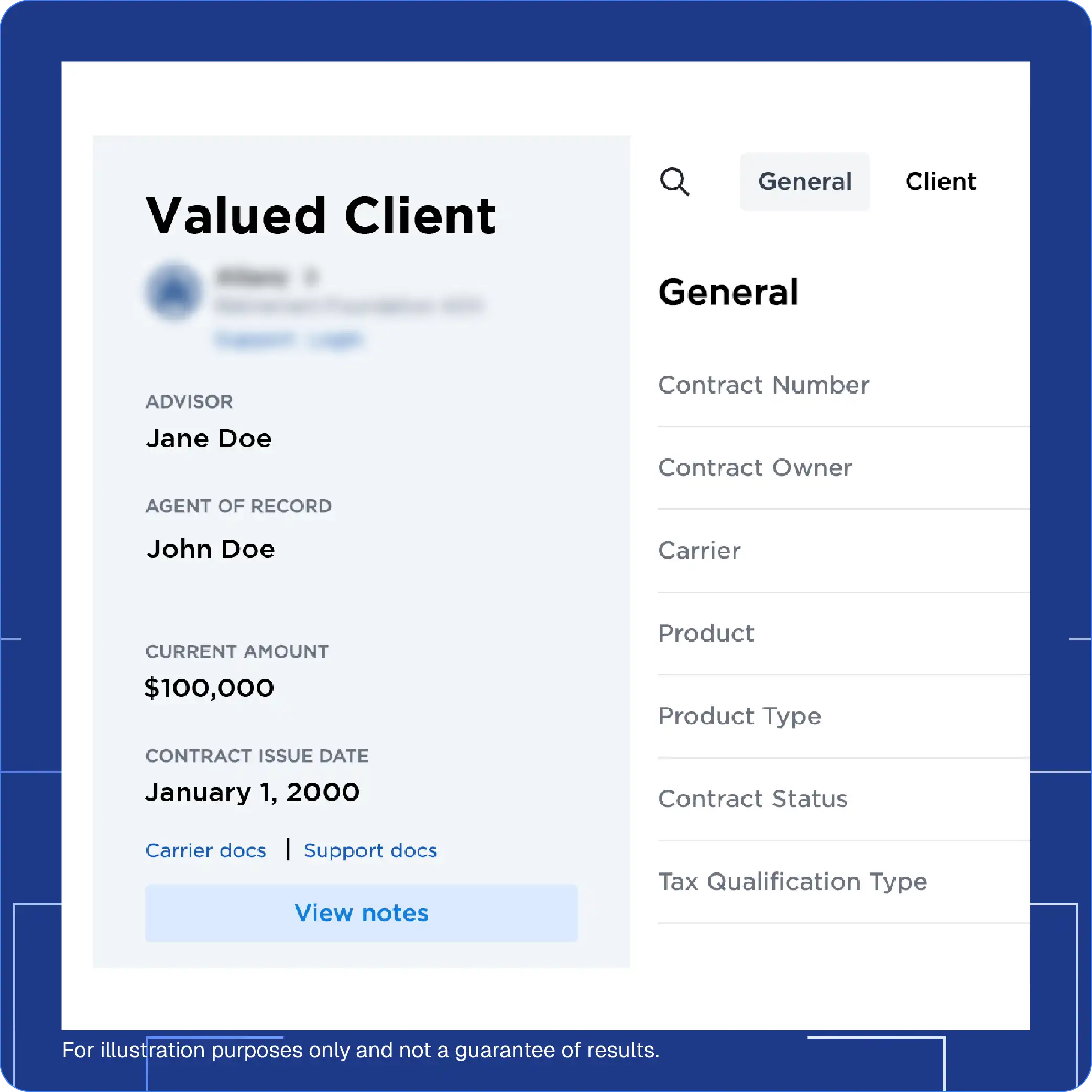

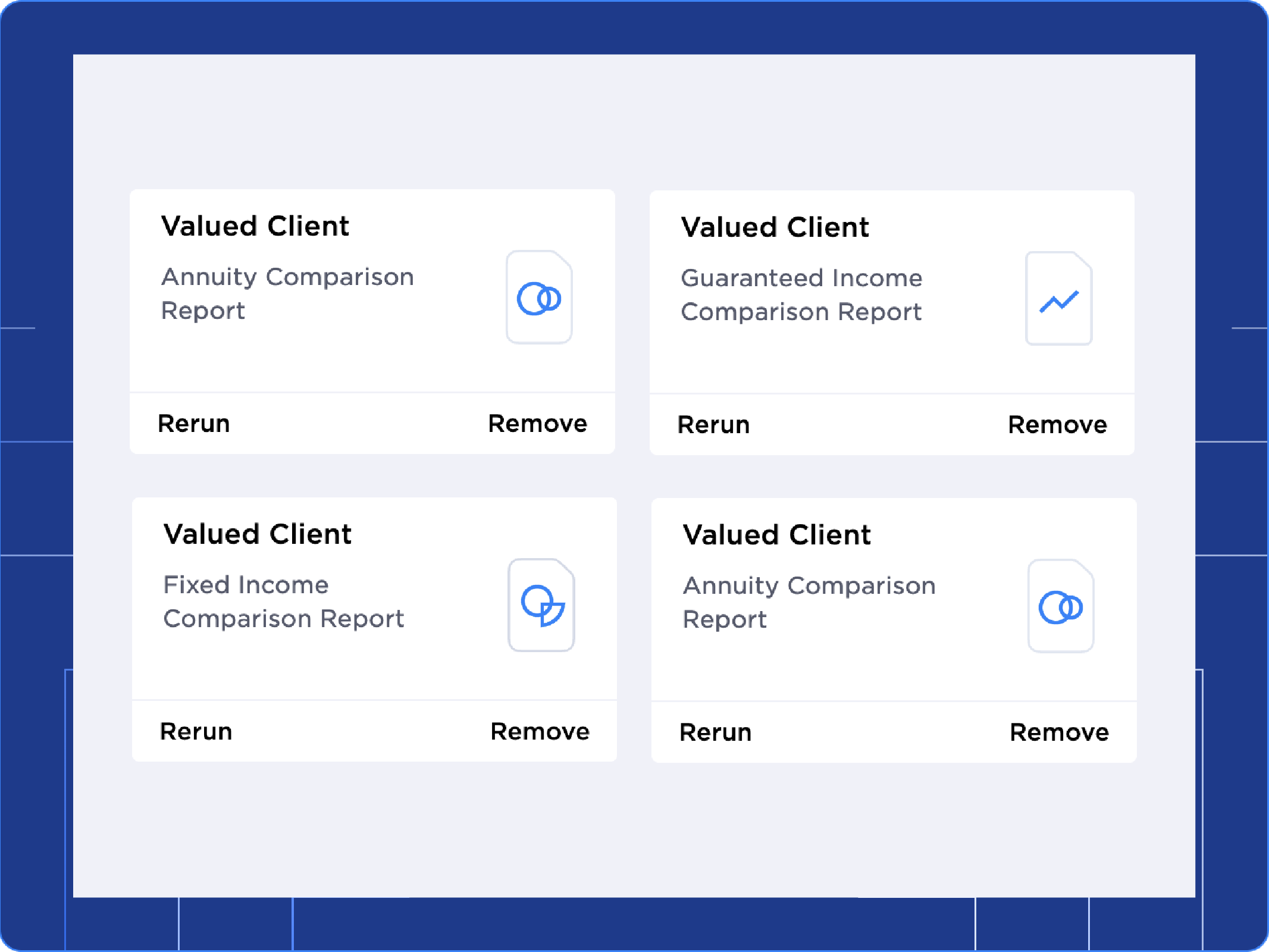

Fulfilling an annuity recommendation for your client has never been easier with our streamlined, digital process.

Why Firms Join DPL

Improve outcomes, elevate your clients’ experience, and grow your business with fee-based annuity and insurance solutions.